International withholding tax and reporting of employee share schemes can be complex and challenging.

Australian companies offering equity to international participants through an employee share scheme must be aware of their global obligations and those applicable to most jurisdictions including but not limited to the USA, UK and most member states of the European Union. The applicable withholding tax rate can be based on one or a combination of income, social security, federal, state and local taxes. Companies should also be aware of potential complexities for their mobile employees, who may have withholding obligations triggered in multiple jurisdictions and/or be tax equalised on incentive income.

Failure to comply with local laws and requirements may lead to heavy financial penalties and regulatory investigations.

As global employee share plan administrators, BoardRoom has deep insight into how different companies address the issues and manage the global risks arising from issuing equity to international and mobile employees. We see the good, the bad and the downright ugly. In the following we review some of the approaches adopted by Australian companies.

Common Australian Approaches

We see Australian companies attempt to understand and manage their withholding tax processes and obligations in different ways. These include:

- Obtaining tax advice from professional service firms who specialise in employee equity taxation

- Obtaining tax advice from payroll managers/other non-employee equity tax specialists; and

- Asking Google/self servicing

The decision on which approach to adopt is primarily driven by cost, followed by factors including risk, the number of international participants, the number of jurisdictions in which the scheme operates and the quantum of equity that may be taxable.

Once the tax treatment has been confirmed, the standard approach by Australian organisations is to sell a portion of vested/exercised shares to cover the withholding tax liability (known as a “sell to cover”) through their employee share plan administrator. However, there are other methods available.

Tax Advice from Professional Service Firms Who Specialise in Employee Equity Taxation

Advice from a tax expert at a professional services firm should carry the least amount of risk for both the company and participants, as advice is being provided by employee equity tax experts. Organisations adopting this approach may experience excessive costs and time consumption. From recent client experiences, tax advisors based in Australia will generally need to reach out to their international colleagues for jurisdiction specific advice. Time delays in employees receiving their equity from their employer, as the employer waits for tax advice, can lead to negative employee experiences. Employees may not be able to transact on their shares until the tax treatment has been finalised. Time delays can also lead to participants missing out on the opportunity to sell their vested shares during designated trading windows. Participants may then be compelled to make compensatory claims against their employer if the share price falls between the taxing event occurring and the participant being able to sell.

Tax Advice from Payrolls/Other Non-Employee Equity Tax Advisors

The success of this approach varies and is dependent on the knowledge and expertise of the payroll manager/advice provider. Non-employee equity tax advisors can be defined as tax professionals for which the provision of employee equity related tax advice is not a core business function. Organisations adopting this approach can be, and often are, exposed to the risks associated with relying upon non-employee equity tax specialists, to provide specialist equity tax advice. In the event of an issue arising from the advice, these advisors may absolve themselves of responsibility, as the client would normally be asked to sign a waiver prior to the provision of advice. Time delays may lead to negative participant experiences if the applicable treatment cannot be confirmed swiftly. Again, participants may be compelled to make compensatory claims against their employer if the share price falls between the taxing event occurring and the participant being able to sell. Participant mobility may also lead to problems, as payroll managers may not have the level of expertise required to accurately compute withholding requirements.

Google / Self Service

Unfortunately, our experience shows some organisations choose to ask Google for tax guidance, usually to avoid costs associated with obtaining specialist advice. It goes without saying that this is an extremely risky approach and this gamble is not advisable.

An Innovative Solution

In this age of disruption and innovation, employee share scheme taxation is not exempt from rapid technological advancements. Forward thinking organisations are developing and implementing solutions to allow process automation, reducing the risks involved with traditionally manual processes. The BoardRoom employee share plan team was recently involved in the implementation of such a solution.

A BoardRoom employee share plan client conducted a review of their internal processes after concern that their current process was not globally standardised. The traditional approach was to rely on jurisdictional payroll teams to manage the withholding tax process. After an applicable taxing event, participants were required to pay taxes via a cheque or payroll deductions. The process varied between jurisdictions and the client concluded that a change was required to reduce exposure to audit, compliance and regulatory risks, whilst improving the participant experience.

After reviewing several viable solutions, the client opted to utilise a technology based solution provided by Deloitte. That solution is called GA Incentives (“GAIN”) and can be summarised as a fully automated technology platform that calculates income, social and regional tax withholding for equity awards delivered to internationally mobile and domestic employees in real time.

Deloitte’s Rob Basker (Global Leader of Equity and Rewards) described the solution at the recent 2018 Global Equity Organisation Sydney Conference:

“Think of it like having the brains of the local country Deloitte equity professional in an automated solution.”

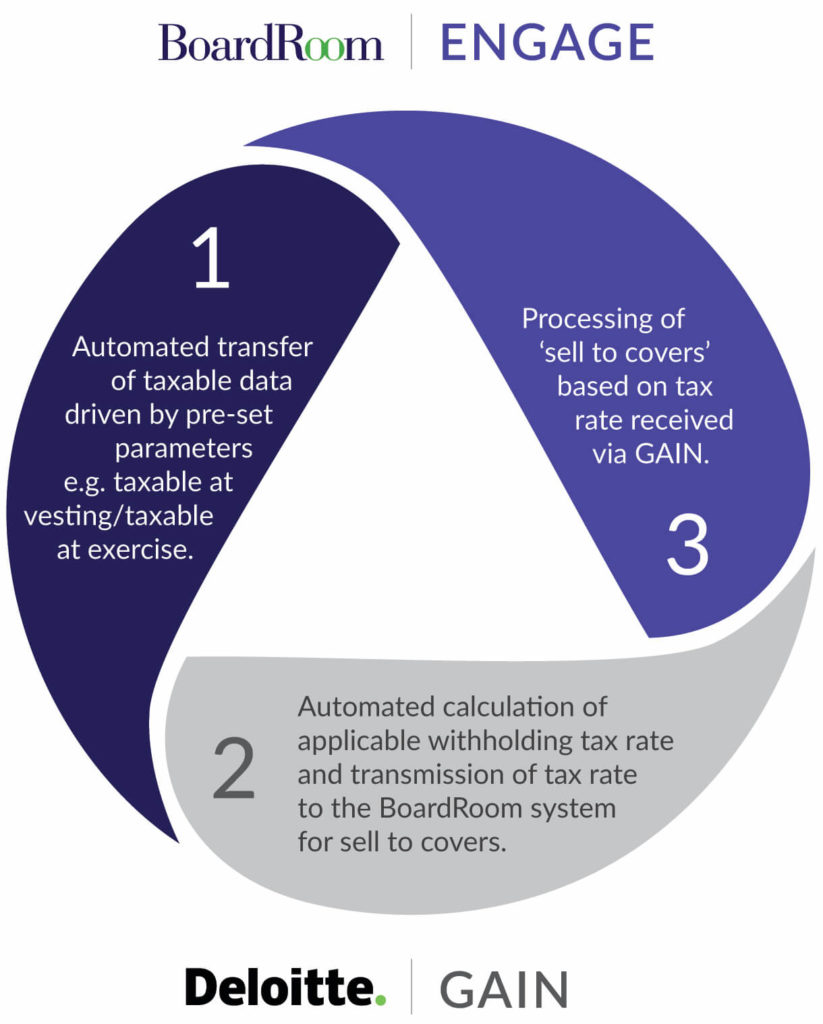

The GAIN system and BoardRoom’s employee share plan management system, Engage, collaborate upon an applicable taxing point being triggered. Engage provides transactional and mobility data to GAIN. GAIN then conducts a real time calculation and returns the applicable withholding tax rate to Engage. Based on market conditions and trading activity, Engage then completes the necessary sell to covers. The diagram below summarises this process.

The implementation of this solution significantly improved the withholding tax experience for the client by delivering a standardised, controlled and reliable process. The organisation found assurance, knowing that they had received expert tax advice from a leading global accounting firm in Deloitte, with administrative processes completed by a leading employee share plan administrator in BoardRoom. The participant experience was also improved by the removal of the requirement to write cheques, make special agreements with payroll managers or store money away specifically to cover the tax bill.

Concluding Remarks

We recommend all Australian organisations offering equity through an international employee share scheme review participant demographics and tax withholding processes to ensure comfort with their procedures and the quality of advice they receive. Government and Tax authorities around the globe are rapidly implementing technology based means of identifying, auditing and penalising organisations found to be in breach of their obligations. At the previously mentioned 2018 Global Equity Organisation Sydney Conference, Rob Basker summarised the current landscape:

“Tax withholding is more than a mathematical exercise. There are many items that need to be factored in which can impact the taxation of equity awards. With global revenue authorities focusing on tax revenues as well as applying interest and penalties to outstanding amounts, the cost of compliance is no longer greater than the cost of noncompliance”

If companies are unsure of their obligations, we recommend obtaining expert tax advice from a reputable professional services firm that specialises in employee equity taxation. It is also vital that the necessary administrative processes, including the sell to cover, are managed by an experienced employee share plan administrator with process and technological capabilities to ensure that withholding tax related tasks are completed quickly, efficiently and most important of all, accurately.