Employee Share Option Plans (ESOPs)

BoardRoom provides an extensive range of services that address employee share option plans (ESOPs) for listed entities on the ASX, NSX, and SSX, as well as unlisted entities, including proprietary companies, unlisted property trusts, equity funds and organisations considering an IPO.

Employee Share Option Plans (ESOPs)

A business is only as good as its employees. Employee Share Plans (ESPs) and employee share option plans (ESOPs) are great schemes for businesses to reward and provide compensation for their employees. While freeing up cash for the company, ESOPs also provide an inherent incentive for employees as they become personally invested in the well-being of your company. This way, you can guarantee that not only will your employees feel valued and respected within the company but also sustain the growth and success of your business.

What are employee share schemes (ESS)?

Employee share schemes are remuneration programmes offered by a company to their employees. They allow employees to buy or be allotted company shares while bringing a wide array of tax benefits, incentives, and more to both the employee and the company.

The only downside to employee share schemes is that they can become increasingly complicated, especially as your company grows. But that’s where an ESOP provider like BoardRoom comes in. We help tailor and manage all the technical aspects of your employee share scheme so that you can focus on what truly matters for your business’s success.

Advantages of an Employee Share Scheme as an Owner

Employee Share Schemes can have numerous advantages for both the employees and the company itself.

- Engagement and Retention: By giving employees a stake in the company, they become more invested in its success. This can lead to a stronger sense of loyalty and commitment, as well as increased motivation and productivity.

- Attracting Talent: In a competitive job market, offering potential employees the opportunity to own a piece of the company can be a major selling point. This can be especially beneficial for small businesses that may not be able to offer as high salaries as larger corporations.

- Potential Tax Benefits. In some countries, there are tax incentives for companies that offer employee share schemes. This can help offset the costs of implementing the program and make it more financially feasible for the company.

What makes an ESS attractive to employees?

ESS not only benefits business owners, but employees also stand to make a gain from ESSs.

- Means of Rewarding Employees: By offering employees a chance to own a piece of the company, they are directly benefiting from their own efforts and contributions. This can help create a sense of fairness and recognition within the company, leading to a more positive and motivated workforce.

- Financial benefits: Employee share schemes provide dividends and potential gains from the company’s growth, making it a valuable investment opportunity for employees. This can also serve as a form of long-term savings or retirement plan for employees.

- Sense of Fairness and Equality within the Company: By giving employees a chance to own a piece of the company, they are directly benefiting from their efforts and contributions. This can help create a positive and collaborative work culture where employees feel valued and recognised for their hard work.

BoardRoom employee equity plans are made for your employees.

In our experience, it’s just not possible to come up with a single equity plan that will work for everyone. That’s why we’ve designed our system to be completely flexible and customisable. Whether it’s an ESP or ESOP, we can provide you with a solution that is purpose-built to meet your needs, increase efficiencies, and reduce costs, all while complying with current and future reporting requirements.

Find out why many of Australia’s largest employers have chosen us to manage their employee equity plans.

Our dedicated employee share plan division is made up of senior staff with significant experience who provide you and your employees with personalised assistance from start to finish. Our ultimate goal is to craft an employee share scheme that strikes the perfect balance between benefiting the company and its employees symbiotically. Whether you have one employee or 100,000, we can add value to your business across various types of employee equity schemes, including:

- Employee share plans (ESPs),

- Employee Share Option Plans (ESOPs),

- Employee performance rights plans,

- Any tailored employee share scheme you have!

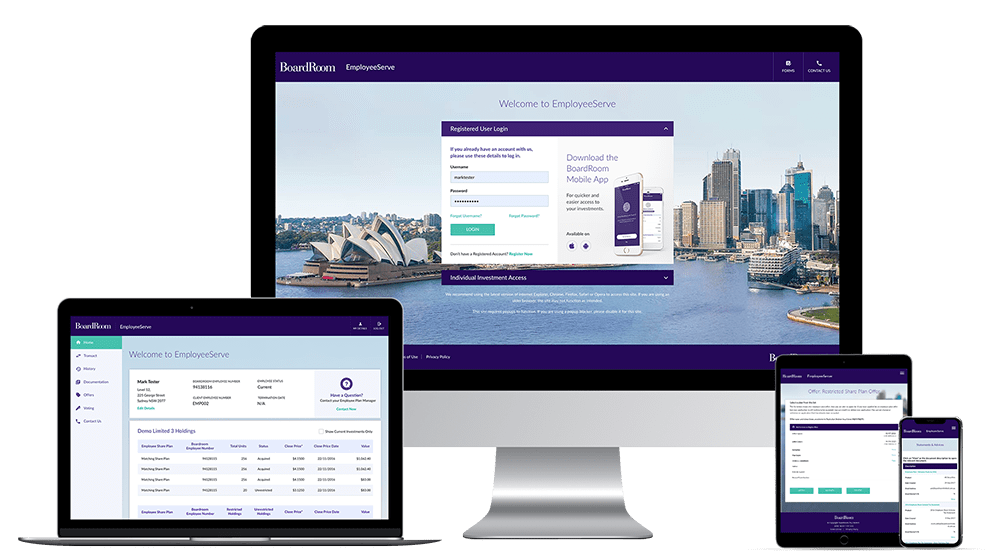

An ESOP platform purpose-built to meet your needs

Our ESOP software is a fully integrated software that provides a powerful engagement tool for our clients and their employees. It is designed to be completely flexible, so your solution is custom-built to meet your Employee Share Plan requirements. With an intuitive user interface, companies can access real-time information quickly and securely anywhere. Our ClientOnline platform allows companies to access real-time detailed information including register snapshots, key alerts and access to a number of detailed reports. Via EmployeeServe, our clients’ employees will be able to view, update and transact on their Employee Equity Plan holdings at anytime, anywhere.

Special Features of our ESOP platform

Designed for real-time mobility

A user-friendly online employee portal, optimised for both web and mobile usage, it provides real-time access to employee holdings around the clock. Through our personalised and branded portal, employees can conveniently update their personal details, including banking and tax information, from any location at any time.

Personalised Support

From setting up plans to management, compliance and reporting, our team delivers personalised support for all your requirements and inquiries.

Multiple-currency platform

Our platform can facilitate the issues, transfers and sales of shares in 250 global currencies, allowing you to manage transactions in your preferred currency.

Enhanced Security

Our platform is built-in with features such as two-factor authentication and regular security updates.

An industry leading ESOP platform for all your needs

Our ESOP platform helps you manage all your ESOP processes effortlessly and ensure maximum employee engagement. Watch the demo below to experience it for yourself now!

By engaging your employees with a professionally managed ESOP or employee share scheme, you will be in a much stronger position to grow and advance your company in the modern business landscape.

If you have any questions, send us a message. A member of our team will get back to you as soon as possible. Arrange a demo with our employee share plan services team to discover what benefits we can bring to you.

We’re here to help

David Park

Business Development Manager

Download our service brochures

Investor Support Enquiries

For shareholder enquiries, please click here to submit your enquiry.

Sales and New Business Enquiries

Frequently Asked Questions

-

What kind of employees are eligible for an employee equity plan?Typically, all employees can participate in an employee equity plan. However, the company can decide which employees can participate, what amount to offer and the conditions that are attached.

-

How can BoardRoom help with your employee equity plan?At BoardRoom, we can manage your Australian or global employee equity plan, from the design phase through to implementation and administration. We have access to leading technologies and a panel of experts to guide you through your implementation and administration needs, ensuring that the process is seamless and worry-free. Our systems are completely flexible, allowing us to tailor a solution to meet your needs. Contact us now to see how we can help your business implement and administer your new employee share option plans or existing employee share scheme.